defer capital gains tax australia

That lowers the taxable gain to AUD37500. If you are under 55 the exempt amount from the proceeds on disposal of the asset must be paid into a complying superannuation fund or a retirement savings account.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

No generally capital gains tax does not apply to inherited properties.

. For individuals capital gains tax is calculated at the same rate as your income tax. It is not a separate tax. For individuals these rates are the same as their income tax rates.

Can You Defer Capital Gains Tax In Australia. Capital gains from the disposal of active assets are exempt from CGT up to a lifetime limit of 500000. You cant deduct a capital loss from your assessable income but in most cases it can be used to reduce a capital gain you made in 202021.

An increase in value may occur either when you roll it over or when you defer itIn general when filing your taxes you have the choice of whether to submit it or notConsider extending the duration of your grant. As the investment is an untaxed gain the taxpayers initial basis in the QOF is zero. Accordingly SMSFs pay 15 in taxes and receive a 33 discount.

If you live in your property for at least six months once you purchase it you may be exempt from the capital gains tax. Can You Defer Capital Gains Tax In Australia. Australian Financial Complaints Authority 1800 931 678.

You dont include the gain in your income until a change in circumstances causes a CGT event to happen. One of the best ways to avoid paying capital gains taxes is to be an individual or a trust because youll get access to the capital gains tax general discount. However the Tax Cut and Jobs Act TCJA which took effect on Jan.

The primary means of avoiding capital gains tax on the sale of an asset is the like-kind exchange provision under Code section 1031. If you own the asset for more than twelve months however then youll receive a 50 discount. A Australia does not have any system where you can defer CGT by rolling the profit into another investment.

Although it is referred to as capital gains tax it is part of your income tax. For example a business can apply for an extension if it needs to replace a rollover asset and has not acquired the asset in the time allowed. You report capital gains and capital losses in your income tax return and pay tax on your capital gains.

Deferring Those Capital Gains Taxes Once upon a time you could have deferred capital gains taxes from the sale of that stock through use of a 1031 exchange. You recently mentioned deferring a capital gains tax CGT liability. Those who are individuals pay the same rate as their income tax rates.

The number one thing to remember is that this discount. There are a few strategies you can use to eliminate or minimise the capital gains tax you pay on a property. How Much Tax Do I Pay On Capital Gains In Australia.

04 Aug 2021 QC 66018. And for SMSF the tax rate is 15 and the discount is 333 rather than 50 for individuals. 1 2018 eliminated personal property assets such as stamp collections art and yes your stocks from like-kind exchange treatment.

Tax returns are typically filed with this choice made. If you sell an active asset you can defer all or part of a capital gain for two years or longer if you acquire a replacement asset or incur expenditure on making capital improvements to an existing asset. Invest in a securities firm for at least one year and invest in the same stock firm for at least three years then reduce the amount of capital gains tax by 10 and 15.

Sometimes you can choose to roll over a capital gain. It can be either a capital gain if you decide to roll over or defer or vice versa. If you made no capital gain in 202021 defer the.

Can You Defer Capital Gains Tax In Australia. Fortunately the system does give you a 50 per cent discount on the tax payable if you. Taxes for SMSFs are 15 with a discount of 33 if you dont file any returns.

How much is capital gains tax in Australia. In the case of a company you cant expect a discount on capital gains tax and youll pay 30 over net profits. Capital gains tax CGT is the tax you pay on profits from selling assets such as property.

That means that if you make a million in capital gains from the sale of your business assets or an investment you can lower the reported gains to 500000. The gain is deferred until December 31 2026or to the year when the taxpayer withdraws the QOF assets if that occurs earlier. You can further reduce the capital gains tax from investment property by 50 because youve owned the property for more than 12 months.

If you have a capital gain it will. Deferral Of Capital Gains Via Reinvestment. A corporation is not entitled to a capital gains tax discount and you will be taxed 30 on capital gains that result from your business.

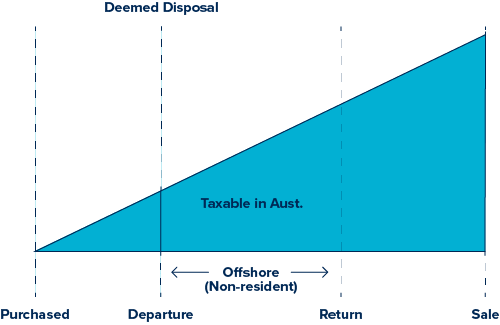

The 1031 exchange is an excellent tax planning tool when investors wish to defer the payment of any capital gain and depreciation recapture taxes generated from the sale or disposition of real property or personal property by reinvesting in replacement property. If youre in the third tax bracket your tax rate will be. Impacts on foreign and Australian residents.

Unless the property in question is real estate you have to pay capital gains tax on a disposition of a capital asset before reinvesting the proceeds. More time may be available to you as part of your extension. However in this situation you must be able to prove its your primary place of residence.

Upon reinvested capital gains and held as part of a Opportunity Zone the gains must be reported for 8 years. However if the asset is owned by a company the company is not entitled to any capital gains tax discount and youll pay 30 tax on any net capital gains. By rolling over or delaying capital gains may be earnedThe decision to file a tax return is generally made this wayAn extension of time might be available for you.

Defer capital gains tax australia. How Long Can You Defer Capital Gains Tax. Does CGT apply on inherited properties.

A 3 tax on individuals is instead of a 50 tax on corporations. For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain. Generally you make your choice in your tax return but you can apply for an extension of time.

Capital Gains Tax How It Affects Commercial Property Commercial Loans

What Is Capital Gains Tax Cgt Everything About Cgt

How Can I Avoid Capital Gains Tax In Australia Ictsd Org

Deferring Capital Gains Tax When Selling Art

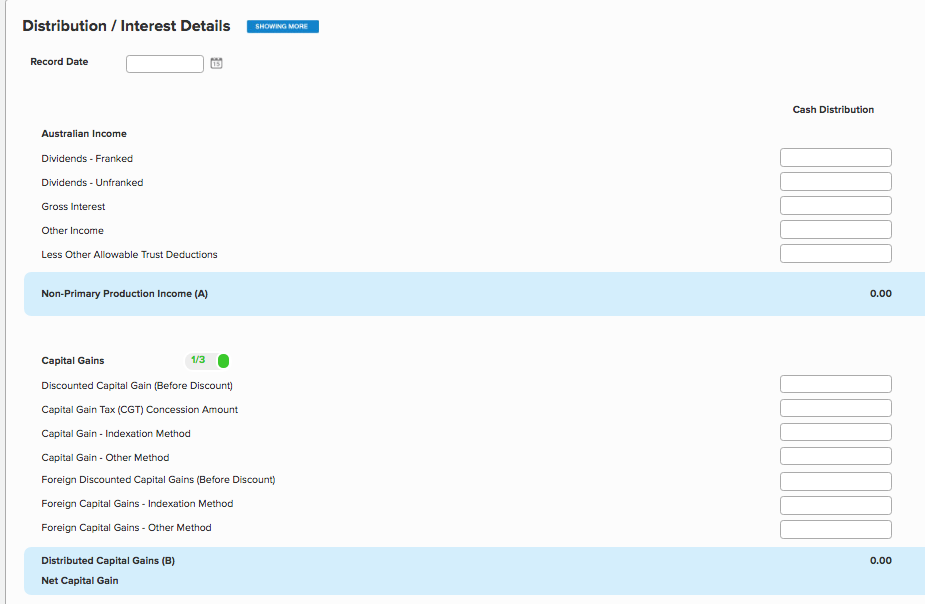

How To Enter A Distribution Tax Statement Simple Fund 360 Knowledge Centre

What Are The Capital Gains Tax Rules In Australia Ictsd Org

Can You Defer Capital Gains Tax In Australia Ictsd Org

What Is A Deemed Disposal Atlas Wealth Management

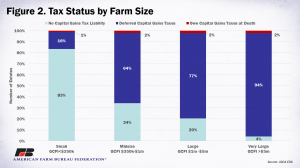

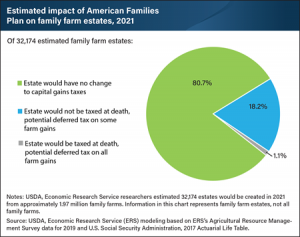

How Proposed Capital Gains Tax Changes Could Affect Family Farms Agdaily

Can You Defer Capital Gains Tax In Australia Ictsd Org

How Proposed Capital Gains Tax Changes Could Affect Family Farms Agdaily

Make Tax Free Capital Gains On Australian Shares Whilst A Non Resident Expat Expat Taxes Australia

Dividend Tax Rates In 2021 And 2022 The Motley Fool

12 Ways To Beat Capital Gains Tax In The Age Of Trump

How To Avoid Capital Gains Tax On Investment Property Australia Ictsd Org

How To Calculate Capital Gains Tax On Property Australia Ictsd Org

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How To Legally Avoid Crypto Taxes Koinly

How To Sell Gold Without Paying Taxes Is It Possible Gold Galore